Investment Analysis - What's The Score?

In this article, I introduce my SCORE approach to cash flow and investment analysis. I then drill-down into the benefit analysis that underpins the revenue assumption and conclude with a personal account of a legal services change programme - with illustrations using Amplify software.

The ‘J curve’ diagram shows a typical project cash flow and is the basis of economic evaluation. There are two parts to the cash flow: the outflow investment – the expense, and then the inflow of revenue – the return. I base all economic analysis on the cash flow. Where I worked, we had two main economic indicators that were calculated for each project and used as part of the business case.

- NPV (Net Present Value) – discounted cash flow at a prescribed cost of capital – discount rate.

- IRR (Rate of Return) – effective interest rate of the cash flows

Let’s look at the assumptions behind the value calculation. These are key to understanding the business case, which is only as good as the underlying assumptions.

What’s the SCORE? Understanding investment analysis

Do you have a favourite sport or TV competition – football or rugby or ‘Strictly Come Dancing?’ What do you look out for? The SCORE! Remember that point as I explain Investment Analysis. I show the five key elements of investment analysis on the diagram – SCORE!

- S = Sanction of the Project

- C = Capital (investment Cost)

- O = Operating Start-up

- R = Revenue Stream/savings

- E = Endurance of the Asset

SCORE is a useful acronym because it implies a reference point and a benchmark for the key assumptions required by the Project Plan. In this article I am focusing on ‘R’ for Revenue which represents the income or savings from the project – the benefits & revenue net of recurring costs – sometimes called the margin. When calculating the Revenue part of the NPV calculation, I recommend conducting an economic analysis that covers the full range of benefits from tangible, to less tangible and intangible. Also known as hard measurable, soft measurable and not measurable. These different benefit types formed part of a benefit catalogue I helped to create whilst working on IT projects in a major corporate organisation.

New Technology for the Lawyers

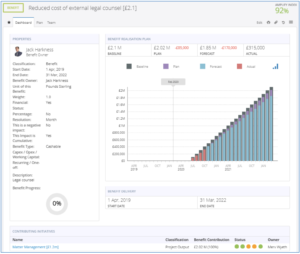

I think lawyers are the most argumentative people to work with. That’s not a prejudice. It’s an observation based on my experience of working with the legal profession, which involves lots of arguing! A new project was being proposed, and part of the business case focused on Increased Revenue generated because of investing in new mobile technology for lawyers. I based the case on improving the efficiency of the legal team (over 200 in-house lawyers around the world) and the benefit as ‘the avoided cost of reduced spend on external counsels providing support, time saved being released to do other work, and the sped-up induction of new staff’. I show the benefits in a benefit flow diagram and associated benefit summary table below.

I incorporated the assumptions on time saved and external counsel hours into a cash flow benefit and equivalent NPV.

I remember presenting to the Global Legal Leadership Team in Los Angeles. I had a room full of lawyers, eyes open and jaws dropping, when I showed them the benefit catalogue and the cash flow curve. The Chief Counsel remarked that this was the first time ever, that the Leadership Team had ever been presented with an NPV report. Suffice to say, he strongly endorsed both the overall strategy and associated projects. With that level of support, you won’t be surprised to know that the new technology, matter management and workflow were implemented, and embraced by the lawyers and benefits realised - although, as you might expect, there are some lawyers in the team who are still arguing about the changes!

Amplify value-delivery software

If Amplify had been available at the time of my Legal Services Technology Programme, I believe that it’s capabilities would have made it a game-changer.

Amplify features include quantitative metrics for measuring benefit and cost, reporting variance against plan, and facilitating enterprise-wide feedback. Amplify supports an integrated value-delivery approach combining the following:

- Delivery of initiatives on-time, on-budget and to scope

- Achievement of financial (e.g., OpEx savings) or non-financial (customer satisfaction) business outcomes

Amplify has a broad range of dashboards such as; NPV, Investment, Stage-Gate Process and Map ROI; updated in real-time, enabling organisations to optimise their investment in projects, programmes, and portfolios. Amplify has built-in benefits realization plans, cost profiles and schedule reporting that supports monitoring and tracking the impact/value of a wide range initiative of types. These include Strategic Programmes, Business Transformation, and Post-Merger Integrations. Request an Amplify Demo today to learn how it helps you to achieve your goals, optimise the ROI of your change initiatives and boost business results.

About Tim Podesta

Tim is passionate about the art and science of Investment Analysis for Projects. After 35-years with BP, as engineer, commercial manager, and programme director, he retired in 2016. He now works as an independent consultant on various assignments. His natural areas of subject matter expertise are Benchmarking, Investment Analysis and Front-End Planning for Projects, based on his extensive industry experience.